How much can your business benefit from ESOP?

Get your free Preliminary Business Assessment, which includes a high-level valuation and debt capacity analysis.

ABOUT US

ABOUT US

Our Team

We have a unified, multi-disciplinary team of in-house investment banking, and consulting

to provide a complete and comprehensive sell-side solution to our clients.

Ambrose’s Unique ESOP Expertise

Ambrose’s Unique ESOP Expertise

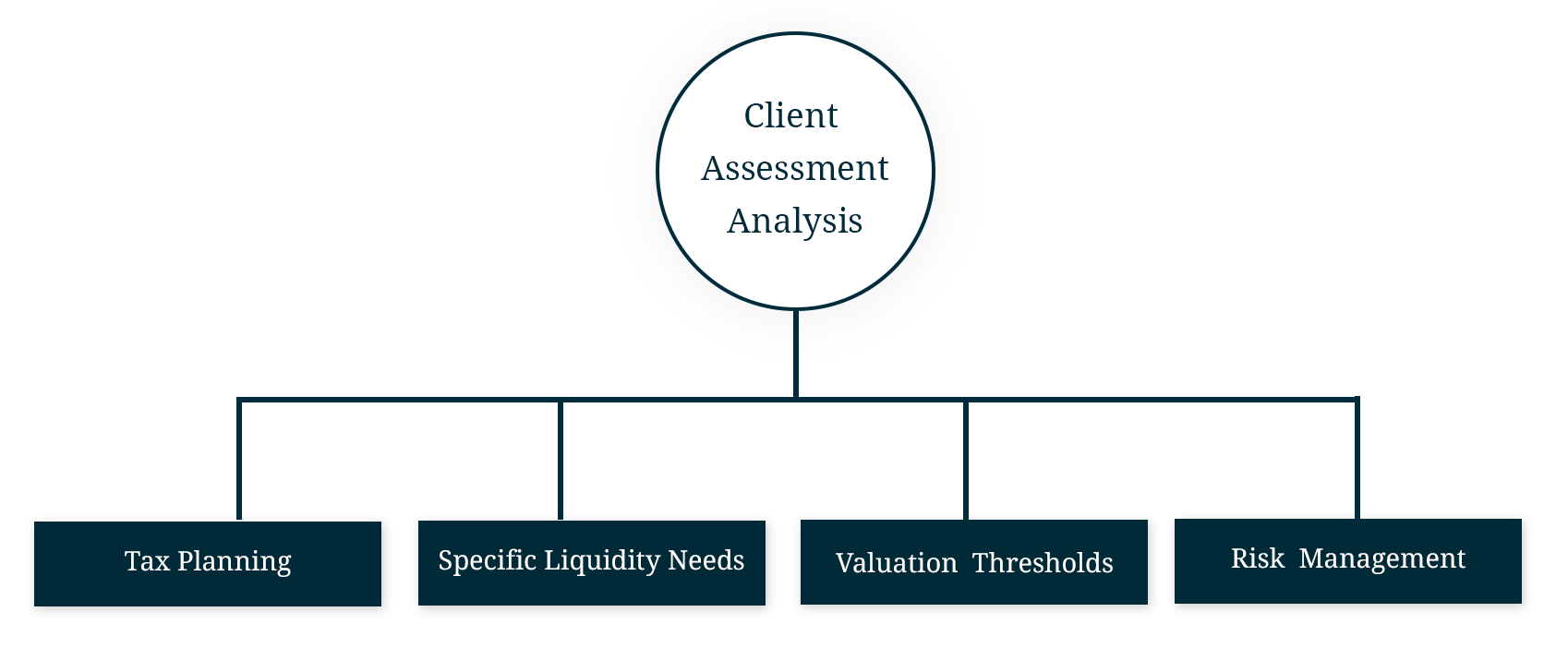

Client Engagement Process

Client Engagement Process

Why Ambrose?

The word “Ambrose” originates from a Greek word meaning immortal, which reflects our long-term solution-oriented focus. We give senior-level attention to every client on every deal and treat the transaction as if we were selling or raising capital for our own business. Unlike most sell-side advisors, we maintain a continuing relationship with our ESOP clients through our TPA practice and our non-ESOP clients by continuing to provide advice until all post-closing obligations are met. In fact, we advise many of our ESOP-owned clients in sales to third parties that provides a repayment of transaction debt to banks and former sellers, as well as cash to the ESOP and its participants

Effective

AmbroseAdvisors™ offers a complete sell-side advisory solution. We seek to create an outcome that rewards selling shareholders, investors and employees. Our multi-disciplinary team of professionals create a working environment that allows us to support the client and their advisors with a unified, experienced team that can handle the full range of the transaction cycle.*